Renewable hydrogen is already becoming cost competitive in a range of heavy transport applications, new government-commissioned analysis has found, and is predicted to become the cheapest of all sources of hydrogen by mid-century.

The analysis, commissioned by the Clean Energy Finance Corporation, found that green hydrogen was already approaching cost competitiveness for use in the heavy trucking, buses and remote power sectors and that by the end of the decade was expected to be viable across more transport sectors.

The report, prepared by consultancy Advisian, found that green hydrogen was quickly becoming a viable alternative to many petroleum-based fuels and had a high potential to also become a viable competitor to fossil gas.

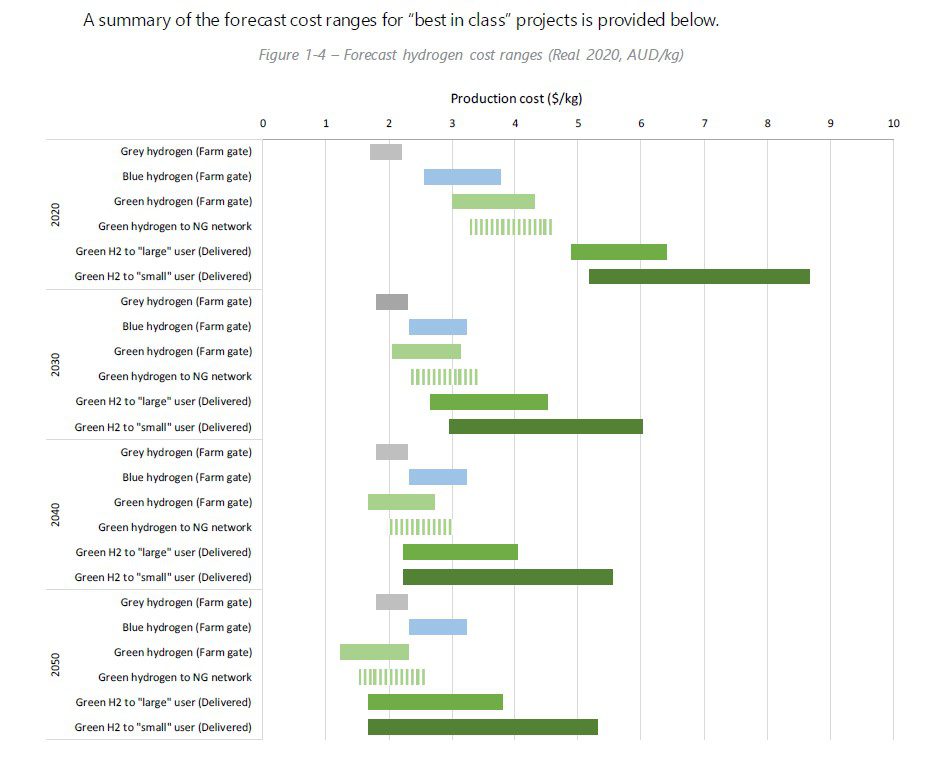

The analysis estimated that the current costs of green hydrogen were around $3.88 per kilogram when produced using onsite supplies of renewable electricity.

But that this cost was expected to fall well below $2 per kilogram by 2050, if not earlier, with renewable hydrogen projected to become the cheapest source of hydrogen – outcompeting both ‘grey’ and ‘blue’ hydrogen produced using fossil fuels on cost.

Advisian said that by 2050 or earlier green hydrogen was likely to be a cheaper source of energy in a range of heavy transport applications, including buses, mining vehicles and aviation, as well as being cost-competitive for use in a number of industrial applications, such as steel mills, methanol and ammonia production.

Interestingly, the assessment found that green hydrogen would remain cost-prohibitive for use in passenger vehicles well beyond 2030, with electric vehicles likely to gain an early foothold in a market to replace conventional ICE vehicles, but green hydrogen could emerge as a highly competitive fuel for light passenger vehicles by 2050, largely thanks to the falling costs of fuel cell technologies.

CEO of the CEFC, Ian Learmonth, said the agency had commissioned the research to provide Australian industries with insights into the opportunities being created by green hydrogen.

“There is enormous excitement around the potential to create green hydrogen to deliver a cleaner and more enduring energy source. As with any new technology, costs will decline over time,” Learmonth said.

“The purpose of this analysis is to give industry participants and investors an understanding of the potential economics for the uses of hydrogen in the Australian context, including potential early adopters. Our experience in developing the solar and wind sectors shows that prices decline rapidly as a new industry reaches scale and technical proficiency. It is encouraging to see a similar trajectory for the exciting hydrogen sector.”

Advisian identified three key trends that were driving the cost competitiveness of green hydrogen. The first two are relatively self-evident – the falling costs of electrolyser technologies and the falling cost of renewable electricity supplies.

The third trend related to necessary improvements in hydrogen facility construction costs and improvements that may be achieved through operational efficiencies. Such improvements are only likely to be achieved through the experience of real-world deployment of green hydrogen projects.

Advisian also identified three areas where green hydrogen had a significant economic potential – particularly to become a significant part of the Australian economy.

These included the displacement of petroleum based fuels, including the use of green hydrogen in transport sectors, the replacement of fossil gas with renewable hydrogen, and the growing export market for hydrogen into overseas markets.

The CEFC’s hydrogen lead, Rupert Maloney, said that Australia was well positioned to leverage its experience as a leading exporter of liquefied natural gas to become a leading exporter of green hydrogen.

“There are opportunities for Australia to play a leading role in developing a hydrogen economy. Our high quality and low cost renewable resources provide a comparative advantage which will be a key driver in achieving competitive hydrogen production costs,” Maloney said.

“We have a proud history and strong reputation for exporting energy to the world, including as one of the world’s largest exporters of LNG. This same skilled workforce can be used to develop and ultimately export new energy vectors such as green hydrogen.”

The CEFC administers a $300 million Advancing Hydrogen Fund, which is expected to help underpin investment in Australia’s early projects in green hydrogen production and use – including by providing co-investment for three large-scale electrolyser projects selected to share in more than $100 million in grants provided by the Australian Renewable Energy Agency.